Options data holds sideways trading

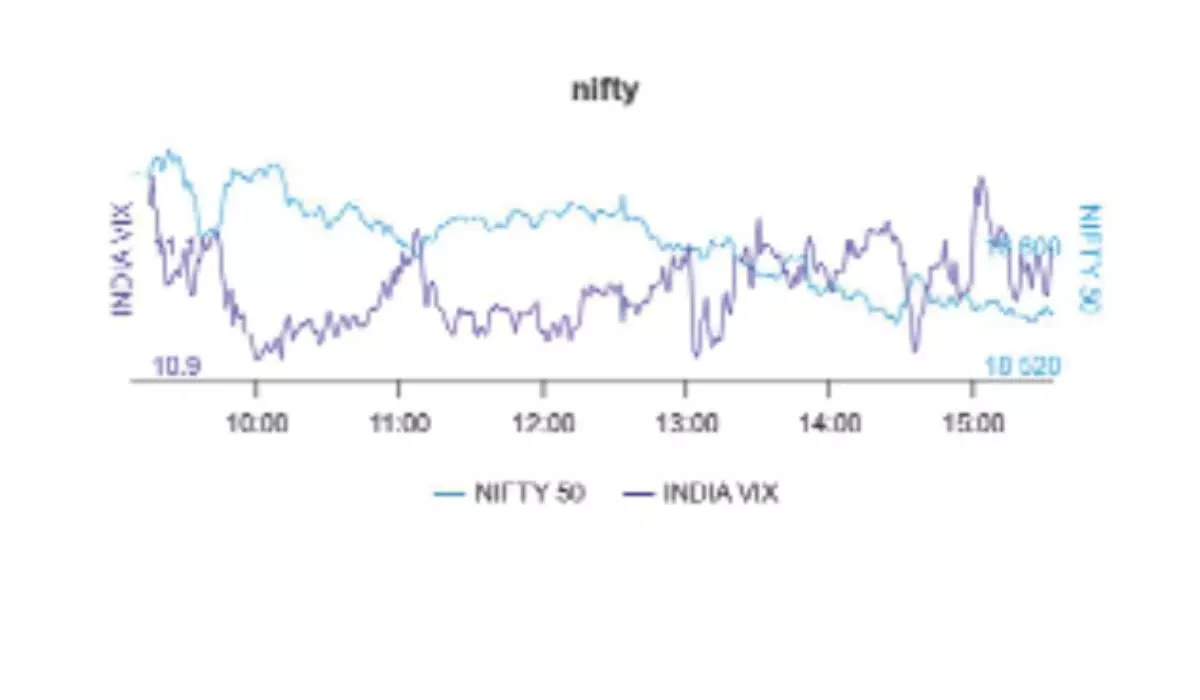

Highest Call & Put bases at same strike price; Fear gauge India VIX fell 1.22% to 11.12 level; Marginal addition in Nifty futures along with a decline in premium indicating accumulation of some short positions at higher levels

image for illustrative purpose

The significant decline in resistance level by 800 points to 18,700CE and 200points rise in support level to 18,700PE point to limited range trading for the week ahead as highest Call and Put bases are at the same strike as per the data on NSE after Friday session.

The 18,700CE has highest Call OI followed by 18,800/ 18,600/ 18,650/ 19,000/ 18,900/ 19,300/ 19,600 strikes, while 18,600/ 18,700/ 18,900/ 18,800/ 18,900/ 19,000 strikes witnessed significant build-up of Call OI.

Coming to the Put side, maximum Put OI is seen at 18,700PE followed by 18,600/ 18,000/18,300/ 18,400/ 18,500/ 18,200 strikes. Further, 18,300/18,600/ 18,500/ 18,450 strikes recorded reasonable addition of Put OI.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “From the derivatives front, hefty Call writing was observed at 18,600 & 18,700 strikes, while Put writers were seen adding marginal Open Interest in lower strikes.”

Call options concentration is more than that at Put strikes. The Open Interest at 18,700 Call strike is over three crore shares making it a crucial hurdle in coming sessions. At the same, the highest Put base is also at the same strike price i.e. 18,700 level, which should act as immediate support level, below which extended weakness towards 18,350 level can be expected.

“Once again Indian markets remained sideways in the week gone by as Nifty and Bank Nifty, both the indices traded in defined range to end the week near unchanged line. Profit booking from higher levels was observed in the later part of the week as Nifty ended below 18,600 mark, while Banking index closed below 44,000 mark on local bourses,” added Bisht.

BSE Sensex closed the week ended June 9, 2023, at 62,625.63 points, a minute gain of 78.52 points or 0.12 per cent, from the previous week’s (June 2) closing of 62,547.11 points. During the week, NSE Nifty edged up by 29.30 points or 0.15 per cent to 18,563.40 points from 18,534.10 points a week ago.

Bisht forecasts: “Technically, the rally seen in the previous weeks, in Indian markets, seems exhausted as of now, as we can expect further rounds of profit booking in upcoming sessions. However, the bias still remains in favor of bulls and we suggest traders use these dips to create fresh longs. We also expect that the market may witness sector rotation in upcoming sessions, as stock-specific action likely to remain on radar. On the downside, Nifty may get support in the 18,450-18,400 levels, while any sharp upside is likely to cap in the 18,650 to 18,750 level.”

India VIX fell 1.22 per cent to 11.12 level. India VIX was hovering at 11 level despite some profit booking at higher levels and upcoming crucial events. Even the US VIX moved below its lowest levels last seen in pre-Covid time. Hence, a rise in volatility remains a key risk for market momentum.

“The Implied Volatility (IV) of Calls closed at 9.49 per cent, while that for Put options closed at 10.57 per cent. The Nifty VIX for the week closed at 11.26 per cent. The PCR of OI for the week closed at 1.36,” observed Bisht.

Nifty futures OI remained low throughout the June F&O series. However, marginal addition was noticed in the last few sessions along with a decline in Nifty premium. This is indicating accumulation of some short positions at higher levels. Moreover, there is not much change in FII positioning in index futures, while cash-based buying from FIIs have seen a pause. In such a scenario, continued consolidation cannot be ruled out.

Bank Nifty

NSE’s banking index closed the week at 43,989 points, a modest fall of 51.15 points or 0.11 per cent from the previous week’s closing of 43,937.85 points.

| F&O Trading | ||||

| Product | Volume | Value (₹/ lakh) | OI | PCR |

| Stock Futures | 7,41,927 | 54,58,394.86 | 30,57,706 | - |

| Index Options | 14,15,31,401 | 44,46,581.83 | 1,08,32,163 | 1.1 |

| Stock Options | 37,91,942 | 4,83,827.70 | 27,54,636 | 0.54 |

| Index Futures | 2,18,277 | 21,52,727.80 | 3,36,944 | - |